Assorted Links 3/16/10 Archives

Assorted Links 3/16/10

Liar Truthteller Brain Teaser

- Word Workshop: Writing for Government and Business: Critical Thinking and Writing, April 15, 2010

- Word Workshop: Writing to Persuade: Hone Your Persuasive Writing Skills, April 16, 2010

- Media Relations for Public Affairs Professionals, May 4, 2010

- Advanced Media Relations, May 5, 2010

- Public Affairs and the Internet: Advanced Techniques and Strategies, May 6, 2010

- Crisis Communications Training, May 7, 2010

- The Empire Continues to Strike Back: Team Obama Propaganda Campaign Reaches Fever Pitch - "This juncture was a crucial window of opportunity. The financial services industry had become systematically predatory. Its victims now extended well beyond precarious, clueless, and sometimes undisciplined consumers who took on too much debt via credit cards with gotcha features that successfully enticed into a treadmill of chronic debt, or now infamous subprime and option-ARM mortgages.

Over twenty years of malfeasance, from the savings and loan crisis (where fraud was a leading cause of bank failures) to a catastrophic set of blow-ups in over the counter derivatives in 1994, which produced total losses of $1.5 trillion, the biggest wipeout since the 1929 crash, through a 1990s subprime meltdown, dot com chicanery, Enron and other accounting scandals, and now the global financial crisis, the industry each time had been able to beat neuter meaningful reform. But this time, the scale of the damage was so great that it extended beyond investors to hapless bystanders, ordinary citizens who were also paying via their taxes and job losses. And unlike the past, where news of financial blow-ups was largely confined to the business section, the public could not miss the scale of the damage and how it came about, and was outraged.

The widespread, vocal opposition to the TARP was evidence that a once complacent populace had been roused. Reform, if proposed with energy and confidence, wasn’t a risk; not only was it badly needed, it was just what voters wanted.

But incoming president Obama failed to act. Whether he failed to see the opportunity, didn’t understand it, or was simply not interested is moot. Rather than bring vested banking interests to heel, the Obama administration instead chose to reconstitute, as much as possible, the very same industry whose reckless pursuit of profit had thrown the world economy off the cliff. There would be no Nixon goes to China moment from the architects of the policies that created the crisis, namely Treasury Secretary Timothy Geithner, Federal Reserve Chairman Ben Bernanke, and Director of the National Economic Council Larry Summers.

Defenders of the administration no doubt will content that the public was not ready for measures like the putting large banks like Citigroup into receivership. Even if that were true (and the current widespread outrage against banks says otherwise), that view assumes that the executive branch is a mere spectator, when it has the most powerful bully pulpit in the nation. Other leaders have taken unpopular moves and still maintained public support.

. . .

So with Obama’s popularity falling sharply, it should be no surprise that the Administration is resorting to more concerted propaganda efforts. It may have no choice. Having ceded so much ground to the financiers, it has lost control of the battlefield. The banking lobbyists have perfected their tactics for blocking reform over the last two decades. Team Obama naively cast its lot with an industry that is vastly more skilled in the the dark art of the manufacture of consent than it is."- Great Idea from Geniuses - "Pension systems already run significantly higher risk than would be acceptable, essentially gambling taxpayer money that should be designated for public employees’ retirement. This mocks any notion of fiscal accountability. If the gambles fail, and according to this New York Times article they likely will, taxpayers will be left holding the bag.

. . .

Buying out failed banks with state pension funds is nothing more than a shell game, moving failure from private banks to public employees to taxpayers. It’s a terrible plan, and Oregon and New Jersey should soundly reject it."- The Mystery of Sudden Acceleration - "In the 24 cases where driver age was reported or readily inferred, the drivers included those of the ages 60, 61, 63, 66, 68, 71, 72, 72, 77, 79, 83, 85, 89--and I’m leaving out the son whose age wasn’t identified, but whose 94-year-old father died as a passenger."

- New Compressed Air Energy Storage Projects - "Alexis Madrigal of Wired reports on compressed air energy storage (CAES) systems which will store compressed air deep underground. Electric power generated from wind blowing during times of low electric power demand gets used to compress air. Then the compressed air gets used to generate electric power when the demand is highest."

- Do You Want to Govern Yourself? Instapundit Talks With Pollster Scott Rasmussen - "Americans, writes famous pollster Scott Rasmussen, don’t want to be governed from the left, right, or center -- they want to govern themselves. That’s why he’s written In Search of Self Governance."

- Stopping Afghanistan’s Fertilizer Bomb Factories - "In Iraq, insurgent networks had a motherlode of military-grade explosives for making roadside bombs. In Afghanistan, fertilizer bombs are the weapon of choice, making detection and interception a much greater challenge, according to the head of the Pentagon’s bomb-fighting organization."

- Nancy Grace Remembered - "No, NG is not dead.

But I do have to remember her on this anniversary of the party on Buchanan Street in Durham."- Great Time to Buy (Famous Last Words) - "Although the National Association of Realtors said for many years that home prices historically don’t fall, actually they do, and sometimes quite sharply. The housing market is complicated, and the future unknowable. Still, for clues to the overall direction of prices, Mr. Ritholtz advises buyers to look at three metrics: the ratio of median income to median home prices, which suggests whether people can afford a house; the cost of ownership versus renting; and the value of the national housing stock as a percentage of gross domestic product.

All those measures were aberrationally inflated during the housing bubble. And they still aren’t back to historical norms. We can get back to the norm in either of two ways, Mr. Ritholtz says: home prices can either drop an additional 15 percent or go sideways for seven years or so, while G.D.P. and income presumably grow.

. . .Mr. [Frank LLosa, a real estate agent working in northern Virginia] thinks that many people -- including him -- would be better off renting. People ought to buy a house for what he calls 'warm and fuzzy feelings,' but they shouldn’t try to predict home prices. Nor should real estate agents, who aren’t much wiser.

'I don’t think real estate professionals should be in the business of telling people when it is a great time to buy,' he said."- What will economists 40 years from now think of us? - "As you may recall, back around 2005 a number of Congressman were insisting that the Chinese revalue the yuan by 27%. In fact, they did revalue their currency by 22% over the next 3 years. But now we are told they need to do another 20% to 40%. And people wonder why the Chinese are so frustrated with the West. Does this game ring any bells? I seem to recall that back around 1970 the US government kept insisting that the Japanese trade surplus was caused by an undervalued yen. Then the yen was revalued 20%, but the “problem” continued. Then another 20%, then another 20%, then another 20%, then another 20%. The yen has now gone from 350 to 90 to the dollar. My math isn’t very good, but that sure seems like a lot of 20% revaluations. And the Japanese still run a current account surplus that is more than half the size of China’s surplus, despite having less than 1/10th China’s population. I think it’s fair to say that international economists have become increasingly skeptical of the notion that simply by manipulating nominal exchange rates you can eliminate current account imbalances that represent deep-seated disparities of saving and investing. But I guess hope springs eternal. Maybe this time it will finally work.

. . .

How many economists today honestly think that if the Chinese give us another 25% revaluation that this will significantly improve America’s economy?"- Vegan Nut-Jobs Attack Lierre Keith - "Lierre Keith, author of the fabulous book The Vegetarian Myth, was attacked by three vegan nut-jobs on Saturday while giving a speech. They threw a pie laced with cayenne pepper in her face. If that doesn’t sound like much of an attack, keep in mind that it’s nearly the equivalent of being attacked with pepper spray. And frankly, I’d be outraged even if the pie was made of whipped cream. (No wait … that would be a dairy product; the vegans would never stoop to such cruelty just to assault a human being.)

Fortunately, Keith is recovering. Jimmy Moore wrote to inquire about her condition, and she replied:

My eyes are still puffy and blurry, but the pain is definitely better. I think the worst part was hearing people cheer my assailants while I was being assaulted. I don’t want to live in a world where people cheer while someone has cayenne rubbed into their eyes.

Yes, people were cheering -- while three men in masks attacked a 45-year-old woman who already has a damaged spine. My, what courage.

I’d like to say I’m surprised, but I’m not. The animal-rights wackos have a long and proud history of attacking soft targets. As my comedian friend Tim Slagle once pointed out, they’ll happily throw blood on women wearing fur -- but strangely, they never feel inspired to attempt a similar protest on men wearing leather."

Fat Head, Wheat belly, and the Adventures of Ancel Keys

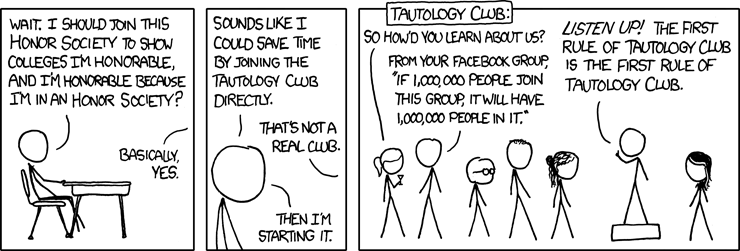

The first rule of Tautology Club

- Spring Break in Mexico? Not a Good Idea - "Avoid all of the Mexican border towns, and I'd also think twice before planning any trips to Acapulco or other popular Spring Break spots.

The tourism smiley-faces like to assure Americans that reports of the the drug-war mayhem are overblown. Baloney. Bloody shootouts and murders are routine occurrences. Like this report today. And, oh,this one.

The State Department issued a travel warning today on Mexico. It issued advice to depart Mexico to families of U.S. consulate employees in the northern Mexican border cities of Tijuana, Nogales, Ciudad Juarez, Nuevo Laredo, Monterrey and Matamoros, through April 12."- Operator Error Usually The Cause of Unintended Acceleration In Past Investigations - "Unintended acceleration is nothing new, and just about every automaker has been the subject of such complaints at some point. The National Transportation Safety Board has received 12,700 such complaints in the past decade, according to Der Spiegel. The problem hounded Audi mercilessly during the 1980s when drivers of the Audi 5000 made claims eerily similar to those voiced by many Toyota owners.

. . .

Engineers investigating the Audi incidents couldn’t find any evidence within the cars to support drivers’ stories of unintended acceleration, Schmidt said. The same is true today: Investigators are unable to find evidence supporting drivers’ claims their Toyotas suddenly raced out of control. One key difference today is the Toyotas in question use electronically controlled throttles whereas the Audis used mechanical linkages. Investigators continue to look into electronics and software related to the Toyota complaints.

Another interesting question is why fatalities stemming from these incidents appear limited to North America, even though Toyotas are sold worldwide. Der Spiegel notes there have been cases of unintended acceleration in Germany, but the drivers simply applied the brakes and brought their cars safely to a stop."- More Evidence 'BestAttorneys' is Clueless about Attorneys - "I wrote here last week about BestAttorneysOnline.com, the dubious new lawyer-rating site that can't seem to get lawyers' practice areas or even their locations straight, listing lawyers as among the top 10 in practices they have nothing to do with and in states in which they have no ties. I followed that with a second post about legal reporter Caryn Tamber's adventures with the site. Now, I have even more to report that only underscores the conclusion that the people behind this site are the gang that couldn't shoot straight of lawyer ratings.

. . .

Is this questionable company actually able to convince lawyers to advertise on this joke of a site? As I said in my original post, when I look at this site, I don't know whether to laugh or cry."- Wheat Ridge High School Class of 1970 - "The reonion committee is working away planning the 40th reunion the weekend of August 13-15, 2010. Wheat Ridge, Colorado WRHS1970.com"

- Common Market Food Co-op - "Common Market Food Co-op was a 'new wave food co-op' located at 1329 California Street in Denver, Colorado, from 1975 - 1980. It started as a buying club at the University of Denver in the early 1970s, and for a few years prior to moving to the old Safeway at 13th and California Streets, Common Market operated out of a small storefront on Champa Street."

Low-key java drinkers in Washington kick off Coffee Parties

- Completely Erase Storage Drives for Security - "No matter how you're getting rid of a computer or external drive, you want all your data removed from it, because identity thieves love laziness."

- Verizon Wireless touts the benefits of a MiFi-connected Apple iPad - "A leaked internal memo reveals that the nation’s largest carrier is trying to jump on the Apple bandwagon by encouraging its employees to push its MiFi device as an accessory to the upcoming iPad. The idea itself is worthy of consideration -- save $130 by purchasing the Wi-Fi version of the Apple iPad and pair it with a MiFi to get 3G wireless connectivity on the go. What Verizon fails to mention is that the MiFi requires a two year contract and will cost $60 per month for the unlimited data plan, meanwhile the 3G iPad can rock on an AT&T unlimited data plan for a mere $30 per month." Uh, yeah, but you can also connect up to 5 WiFi devices to the mifi....

- T.C. Williams stings from low-achievement label; school officials pledge refor - "Federal education officials have singled out Alexandria's only public high school as among the nation's poorest-performing schools, putting it on track for a dramatic turnaround effort, including major instructional reforms and possibly widespread teacher firings.

T.C. Williams High School was one of 17 schools in Virginia to be labeled a 'persistently lowest achieving school' by state and federal education officials this month, based on average reading and math test scores over the past two years.

. . .

It qualifies for the federal turnaround funding because its standardized test scores in 2008 and 2009 fell in the lowest 5 percent of 128 Virginia high schools that have similar poverty demographics but do not receive funding under Title I, a federal program that provides extra resources to schools with large numbers of poor and at-risk students.

. . .

'We have a good foundation,' [Alexandria City Schools Superintendent Morton] Sherman said. 'We are not a great high school, but we are going to be.'"- 3M Self-Sealing Pouches - "These are very sturdy, inexpensive self-laminating folders to make luggage tags, or actually any gear. I wanted to make my own tags from my business cards and these were far and away the best option I found."

- The US Postal Service's Business Model Is Outdated. Is It Time To Wind It Down Or Privatize It? - "Just recently, we discussed whether or not ceasing Saturday delivery was a good idea or not for the USPS. John Potter, the US Postmaster General, recently said that the postal service's business model is as outdated as the newspaper industry's."

March 16, 2010 08:17 AM Caught Our Eye