From the Congressional Glossary – Including Legislative and Budget Terms

Budget Process

Established by the Congressional Budget and Impoundment Act of 1974, the budget process refers to the steps necessary for adoption of a concurrent resolution on the budget, thereby creating the framework for consideration of appropriations bills and authorizing legislation.

The Joint Select Committee on Budget and Appropriations Process Reform is an effort to repair the current system discussed here.

The President’s Budget Request. Due by the first Monday in February, the budget process starts with receipt of the President’s budget request, which defines the Administration’s policy and funding priorities. The Office of Management and Budget, the budget arm of the Administration, is responsible for compiling and submitting the President’s request.

The Congressional Budget Process. The Congressional Budget Office, which provides nonpartisan budgetary analysis to the House and Senate Budget Committees, is required to publish its report of the economic and budget outlook by February 15. The Budget Committees use this report’s baseline budgetary projections as a benchmark from which to build the budget resolution and measure proposed policy changes. Working closely with authorizing and appropriations committees, the Budget Committees then mark up and report out budget resolutions that reflect the priorities of each chamber. Differences are then resolved between the two chambers.

The Budget Resolution. The budget resolution addresses the entire federal budget, including: mandatory spending, discretionary spending, revenue levels, and debt levels. The budget resolution provides an overarching vision for the future and a comprehensive plan for addressing the government’s fiscal challenges. It provides Congress with enforceable targets for the subsequent consideration of appropriations and authorizing bills. It also contains various budgetary rules and limits for the purpose of enforcement. Current law requires the budget resolution to cover at least five fiscal years; however, since fiscal year 2012, it has covered 10 fiscal years.

Reconciliation. In addition to setting parameters for spending and revenue, the budget resolution may drive major program reforms through reconciliation instructions. Under reconciliation, authorizing committees must report legislation adjusting programs in their jurisdictions to meet specified spending and revenue targets. Passage of reconciliation legislation requires only a simple majority in the Senate.

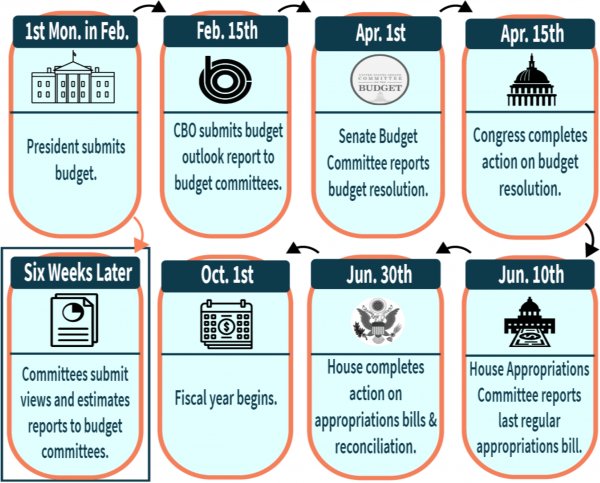

Deadlines. The Budget Act sets out a number of deadlines within the budget process (see chart). Since there are no consequences for inaction, Congress frequently misses these statutory deadlines.

From the House Budget Committee.

Funding the Government: The Budget Process and Omnibus Spending Bills [Article I Initiative]

Congress enacted legislation in 1985 to strengthen its then-11-year-old budget process (Congressional Budget and Impoundment Control Act of 1974) with the goal of balancing the federal budget by fiscal year 1991. The law, called the Balanced Budget and Emergency Deficit Control Act but commonly known as Gramm-Rudman-Hollings for its congressional sponsors, was amended in 1987 so the federal budget would be balanced by 1993. The law established annual maximum deficit targets and mandated automatic across-the-board cuts (“sequestration“) if the deficit goals were not achieved through regular and appropriations action (See also Sequestration.)

The Gramm-Rudman-Hollings law also established an accelerated timetable for presidential submission of budgets and for congressional approval of budget resolutions and reconciliation bills, two mechanism created by the Congressional Budget and Impoundment Control Act of 1974. Budget resolutions, due by April 15 annually, set guidelines for congressional action on spending and tax measures. The resolutions are adopted by the House and Senate but are not signed by the president and do not have the force of law. Reconciliation bills, due by June 15, actually make changes in existing law to meet budget resolution goals.

In 2011 Congress passed the Budget Control Act of 2011, which, among other things, increased the debt limit and created the Congressional Joint Select Committee on Deficit Reduction.

More

- Budget Resolution (CongressionalGlossary.com)

- Reconciliation (CongressionalGlossary.com)

- President’s Budget (CongressionalGlossary.com)

- Sequester / Sequestration (CongressionalGlossary.com)

- “Introduction to the Federal Budget Process,” CRS Report 98-721 (38-page PDF

)

) - “The Congressional Budget Process Timeline,” CRS Report R47235 (15-page PDF

)

) - “The Congressional Budget Process: A Brief Overview,” CRS Report RS20095 (12-page PDF

)

) - “The Budget Reconciliation Process: Stages of Consideration,” CRS Report R44058 (16-page PDF

)

) - “Budget Reconciliation Measures Enacted Into Law Since 1980,” CRS Report R40480 (18-page PDF

)

) - “Provisions Affecting the Congressional Budget Process Included in H.Res. 5 (115th Congress),” CRS Report R44769 (11-page PDF

)

) - “Overview of Funding Mechanisms in the Federal Budget Process, and Selected Examples,” CRS Report R44582 (45-page PDF

)

) - “Points of Order in the Congressional Budget Process,” CRS Report 97-865 (21-page PDF

)

) - “Advance Appropriations, Forward Funding, and Advance Funding: Concepts, Practice, and Budget Process Considerations,” CRS Report R43482 (34-page PDF

)

) - Principles of Federal Appropriations Law, GAO’s Red Book – GAO

- “Fiscal Year 2018 Defense Spending Under an Interim Continuing Resolution,” CRS In Focus IF10734 (3-page PDF

)

) - “The Budget Control Act: Frequently Asked Questions,” CRS Report R44874 (21-page PDF

)

) - “The Debt Limit Since 2011,” CRS Report R43389 (44-page PDF

)

) - “A National Disgrace: The federal budget process threatens America’s future.” By John Steele Gordon, City Journal, February 19, 2021

Courses

- Congressional Operations Briefing – Capitol Hill Workshop

- Drafting Federal Legislation and Amendments

- Writing for Government and Business: Critical Thinking and Writing

- Custom Training

- Congressional Operations Poster, with Federal Budget Process Flowchart

- Federal Budgeting, a Five-Course series on CD

- Congress, the Legislative Process, and the Fundamentals of Lawmaking Series, a Nine-Course series on CD

Publications

The Federal Budget Process 2E |

Pocket Constitution |

Citizen’s Handbook to Influencing Elected Officials: A Guide for Citizen Lobbyists and Grassroots Advocates |

Congressional Procedure |

CongressionalGlossary.com, from TheCapitol.Net

For more than 40 years, TheCapitol.Net and its predecessor, Congressional Quarterly Executive Conferences, have been teaching professionals from government, military, business, and NGOs about the dynamics and operations of the legislative and executive branches and how to work with them.

Our custom on-site and online training, publications, and audio courses include congressional operations, legislative and budget process, communication and advocacy, media and public relations, testifying before Congress, research skills, legislative drafting, critical thinking and writing, and more.

TheCapitol.Net is on the GSA Schedule, MAS, for custom on-site and online training. GSA Contract GS02F0192X

TheCapitol.Net is now owned by the Sunwater Institute.

Teaching how Washington and Congress work ™